How XIRR Works?

Understanding returns when investments are irregular

XIRR, or Extended Internal Rate of Return, is one of the most powerful tools investors can use to evaluate the performance of investments involving multiple cash flows at irregular intervals — such as SIPs, lump sums, redemptions, or even ad-hoc additions.

Why Traditional CAGR Doesn’t Work

- CAGR assumes one-time investment and one final value — not practical for most investors.

- But when you invest multiple times — say, monthly via SIP — CAGR gives misleading results.

- This is where XIRR steps in.

What is XIRR?

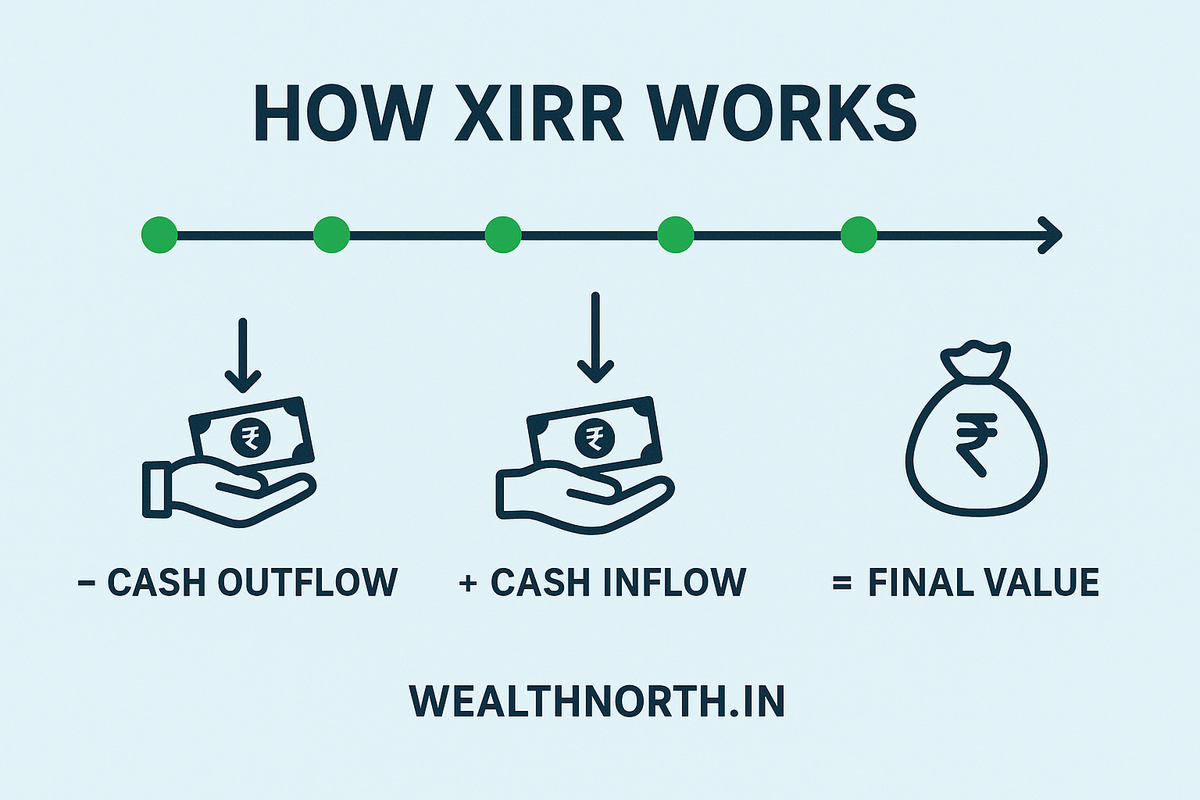

XIRR stands for Extended Internal Rate of Return. It calculates the annualized return considering:

- Each investment amount

- The date of each transaction

- The final redemption or current value

It uses the same logic as Excel or Google Sheets’ XIRR function.

How XIRR Works – A Simple Example

| Date | Cash Flow |

|---|---|

| 01-Jan-2022 | -₹50,000 |

| 01-Mar-2022 | -₹25,000 |

| 01-Jan-2024 | +₹90,000 |

In this case:

- You invested ₹75,000 across two dates.

- You redeemed ₹90,000 after 2 years.

- XIRR calculates the effective annual return from this series of cash flows.

What Makes XIRR Great?

- It’s time-sensitive – it considers when you invest.

- It’s accurate for SIPs, SWPs, top-ups, and partial exits.

- It shows how your investments actually performed — in real life.

When Should You Use XIRR?

Use XIRR when:

- You have made multiple investments or redemptions over time

- You want to compare two different portfolios

- You are tracking SIPs or withdrawals via SWP

In short, it’s the gold standard for evaluating realistic mutual fund returns.

How to Calculate XIRR?

You can use tools like:

-

Google Sheets:

=XIRR(values, dates) -

Excel:

=XIRR(range of amounts, range of dates) - Wealth North’s XIRR Calculator — built with Indian investors in mind

Final Thoughts

XIRR is essential for smart investors. Whether you're building wealth via SIPs or exiting in parts, XIRR helps you see the true picture.

“If you can't measure it, you can't improve it.” — Peter Drucker

So go ahead — calculate your actual returns, and make smarter investment choices!